12 minutes

Payroll adjustments

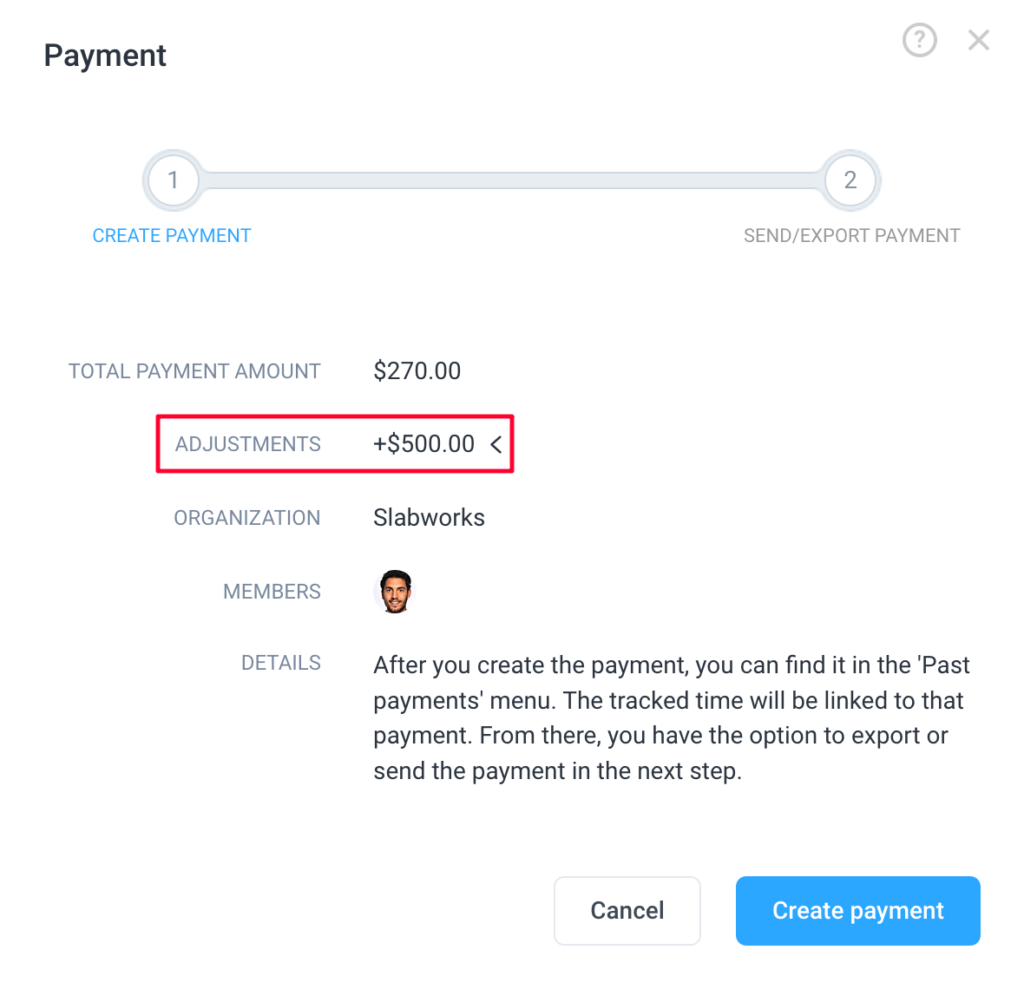

Trying to add payroll adjustments for your team? With our payment additions and deductions feature, you can now automatically make adjustments to your team payments.

Pay periods are required to receive payroll adjustments. You can set pay periods after creating the payroll adjustment.

Only members with time worked, PTO, or holidays will receive adjustments.

Setting up a one time payroll adjustment

One time payroll adjustments are single payments that are added or deducted to a team member’s payroll. To set this up, follow these steps:

Step 1

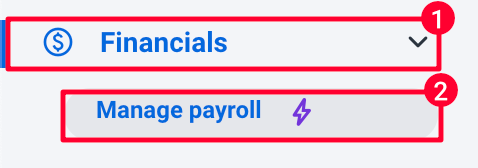

Navigate to Financials > Manage Payroll.

Step 2

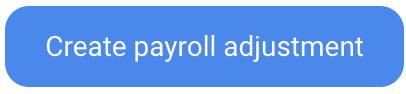

Click on Create payroll adjustment.

Step 3

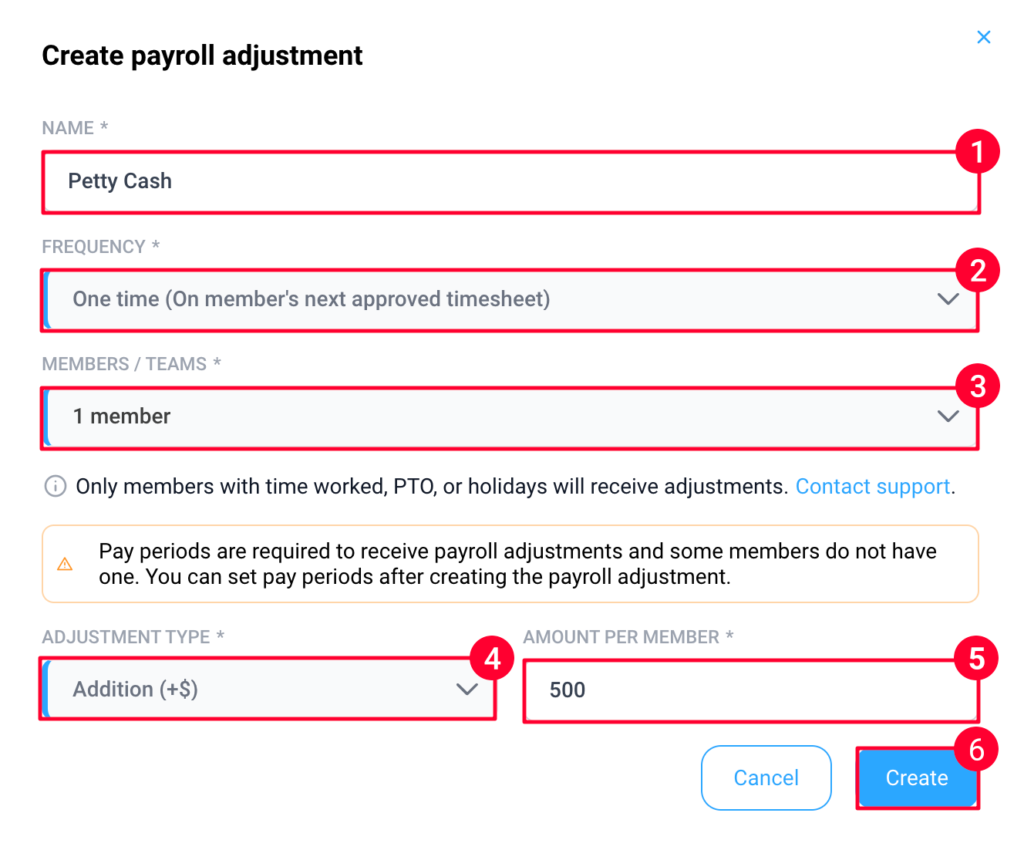

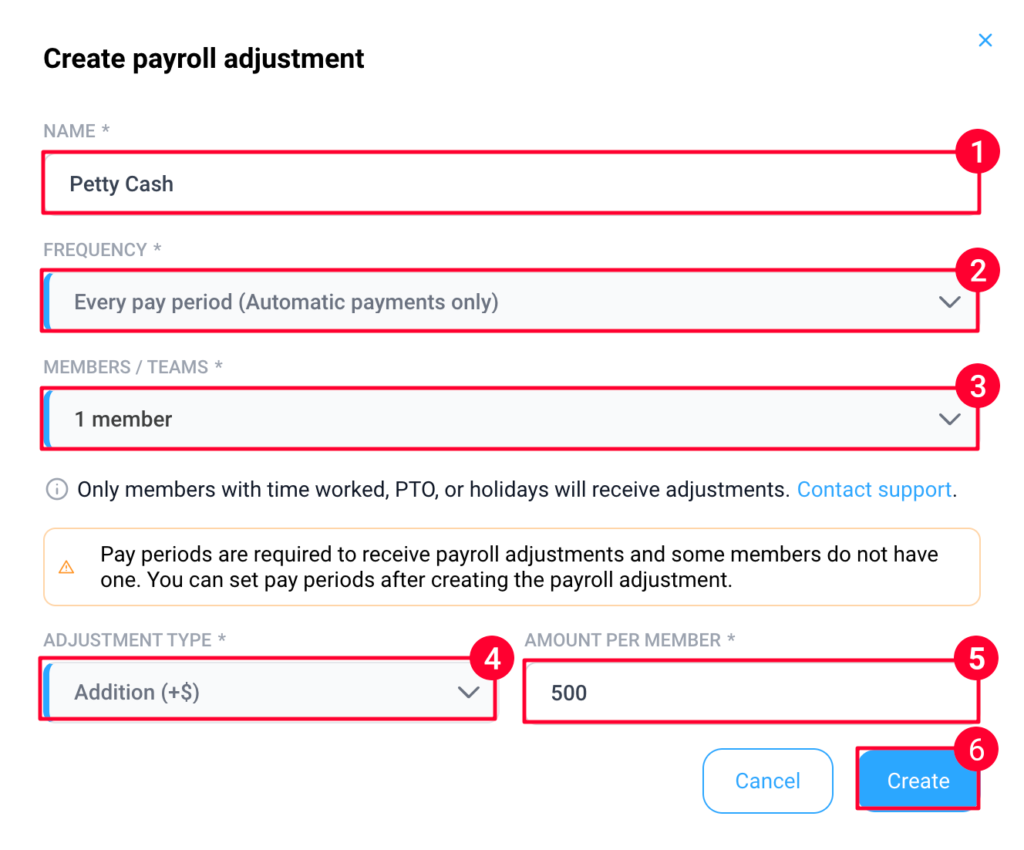

The Create payroll adjustment dialog box will open. Fill in the following details:

- Adjustment name

- Frequency – set to one time

- Members – persons whose pay will be added or deducted.

- Adjustment type – addition or deduction

- Amount per member

Then click Create.

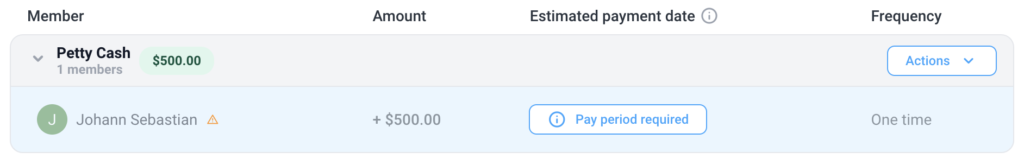

Step 4

Done. You should see the payroll adjustment created now.

Setting up a recurring payroll adjustment

Recurring payroll adjustments are payment additions/deductions that repeat every pay period. To set this up, follow this guide:

Step 1

Navigate to Financials > Manage Payroll.

Step 2

Click on Create payroll adjustment.

Step 3

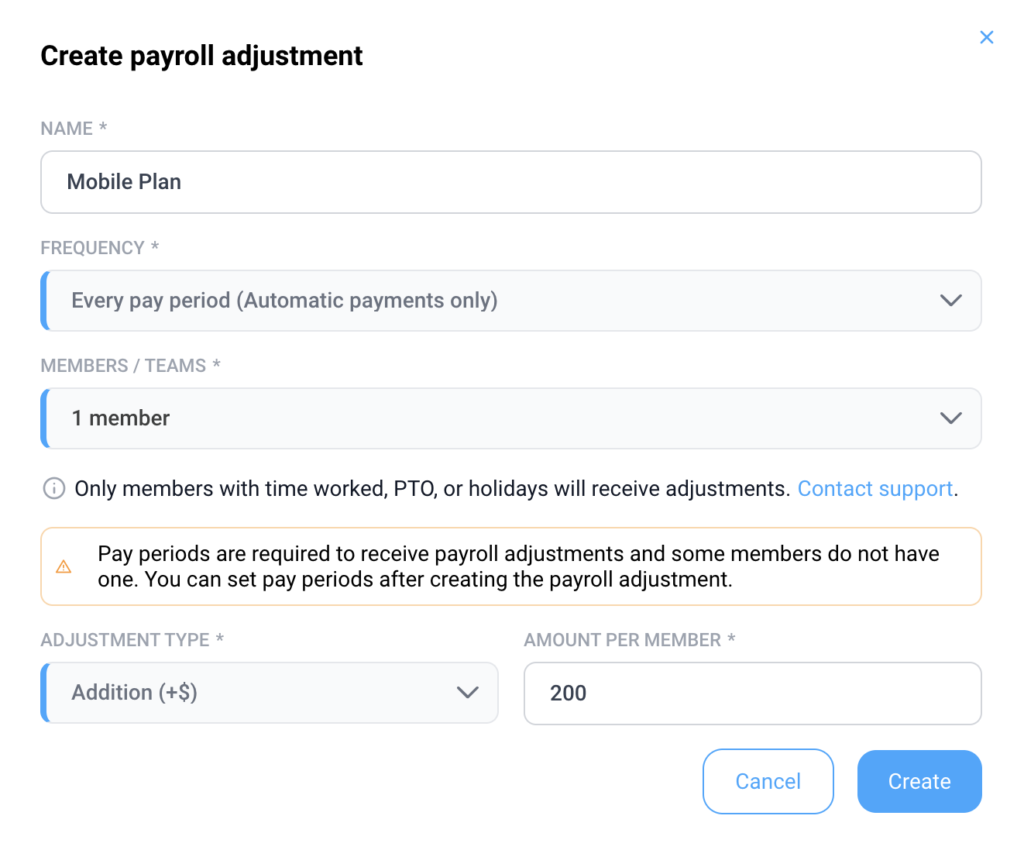

The Create payroll adjustment dialog box will open. Fill in the following details:

- Adjustment name

- Frequency – set this to Every pay period.

- Members – persons whose pay will be added or deducted.

- Adjustment type – addition or deduction

- Amount per member

Then click Create.

Recurring payments will only apply to automatic payments.

Recurring payments will only apply to automatic payments.If the payroll adjustment is a deduction and the payment amount is lower than the deduction, it won’t be applied. The deduction will instead carry over to the next pay period, as long as the payment meets the required criteria..

Editing a payroll adjustment

To edit a payroll adjustment item, follow these steps:

Step 1

Navigate to Financials > Manage Payroll.

Step 2

Navigate to the Payroll adjustments tab.

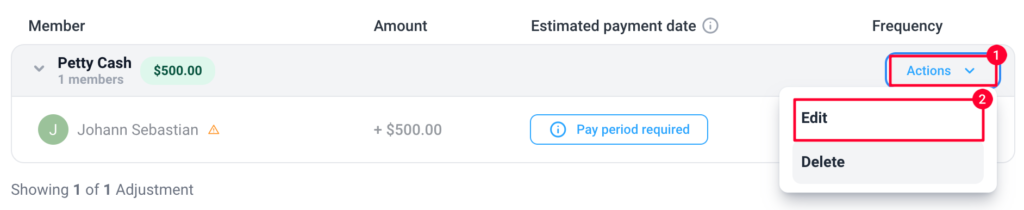

Step 3

Click on Actions > Edit next to the name of the payroll adjustment line item you wish to revise.

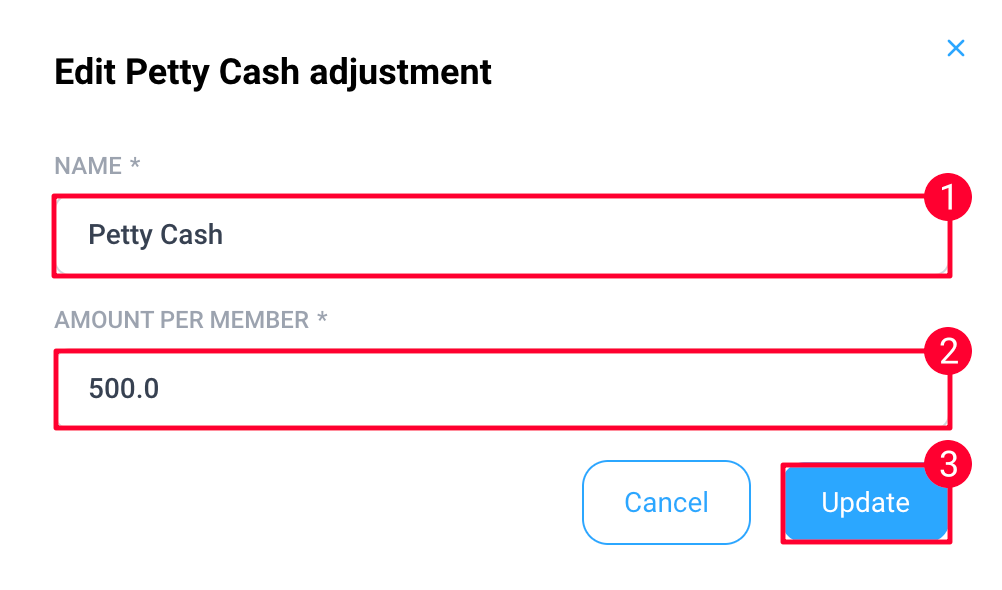

Step 4

Make the necessary changes then click Update.

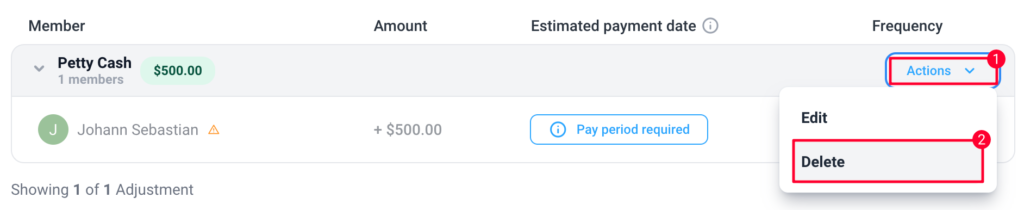

Deleting a payroll adjustment

To delete an existing payroll adjustment, follow this guide:

Step 1

Navigate to Financials > Manage Payroll.

Step 2

Navigate to the Payroll adjustments tab.

Step 3

Click on Actions > Delete next to the name of the payroll adjustment line item you wish to delete.

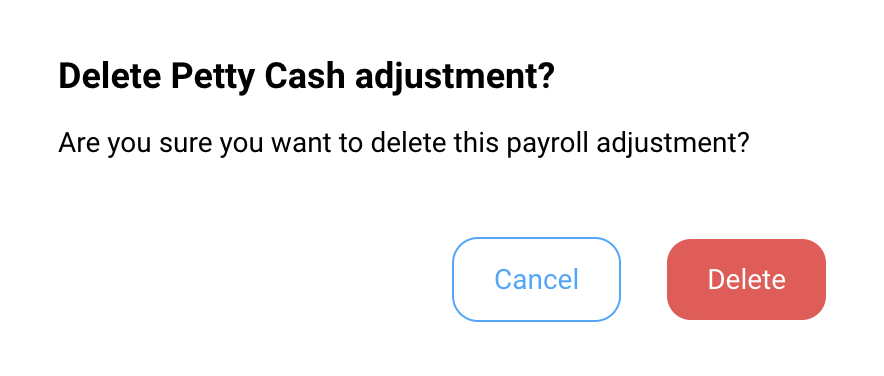

Step 4

Click Delete.